In today’s fast-paced and ever-evolving world, navigating the complexities of personal finance can be a daunting task. From managing budgets to understanding investment strategies, acquiring financial literacy has become more crucial than ever before.

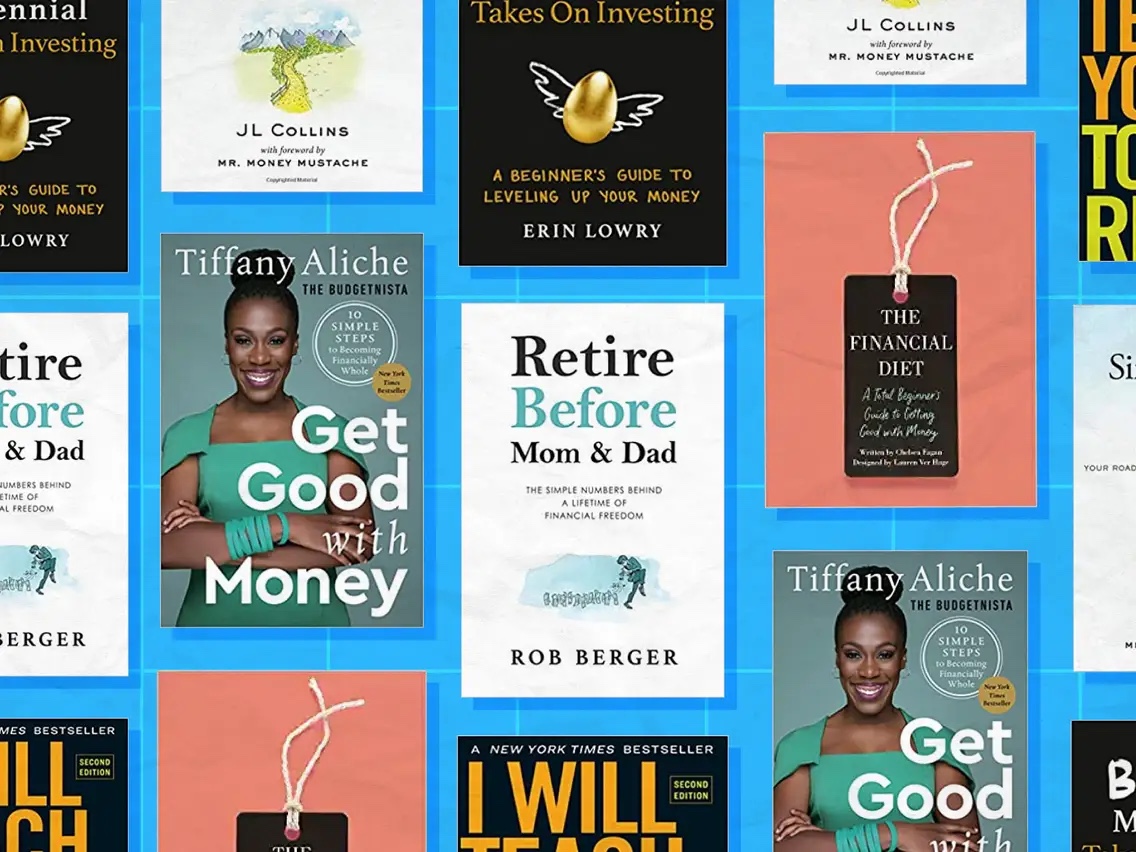

These carefully selected personal finance books have stood the test of time, transcending generations, and transforming the lives of countless individuals. Each offering a unique perspective and invaluable lessons, they serve as indispensable companions on the path to financial success. Whether you are a passionate learner or simply seeking to refine your financial acumen, these books are bound to enlighten, inspire, and shape your financial journey in ways you never thought possible.

We're an affiliate. We hope you love the products we recommend! Just so you know, we may collect a share of sales or other compensation from the links on this page. Thank you if you use our links, we really appreciate it!Best personal finance books for beginners and young adults

1. Rich Dad Poor Dad

Rich Dad Poor Dad by Robert Kiyosaki emphasizes the importance of financial education, arguing that true wealth is built through understanding and applying financial intelligence. Kiyosaki introduces concepts such as assets versus liabilities, cash flow management, and the power of investing in income-generating assets. By encouraging readers to think beyond traditional employment and explore avenues such as real estate and entrepreneurship, Kiyosaki inspires a shift in perspective towards financial independence.

“The poor and the middle class work for money. The rich have money work for them.”

One of the most memorable quotes from the book. This encapsulates Kiyosaki’s core message of building a mindset that prioritizes financial literacy and acquiring assets that generate passive income. This quote serves as a powerful reminder of the importance of shifting from being a mere worker to becoming an investor and business owner.

What will I learn from this book?

- The Importance of Financial Education

- Differentiating Between Good Debt and Bad Debt

- The Power of Financial Independence

- Understanding the Importance of Cash Flow

- Building a Strong Entrepreneurial Mindset

- Overcoming Fear and Taking Calculated Risks

By diving into these additional points, “Rich Dad Poor Dad” will equip you with a comprehensive understanding of financial principles, mindset shifts, and actionable strategies that can propel you towards a path of financial independence and wealth creation.

Click here to buy:

2. Think And Grow Rich

“Think and Grow Rich” by Napoleon Hill is an iconic self-help book that delves into the psychology of success and abundance. Hill’s timeless principles and actionable insights have inspired millions of readers worldwide to unlock their potential and achieve their goals.

One of the greatest strengths of “Think and Grow Rich” is its focus on the power of the mind and the significance of one’s thoughts and beliefs in shaping one’s reality. Hill asserts that success starts with a burning desire, followed by a definitive plan and unwavering faith in its attainment. The book outlines the importance of maintaining a positive mental attitude, overcoming fear and self-doubt, and cultivating resilience in the face of adversity.

A standout feature of “Think and Grow Rich” is Hill’s extensive research on the lives and achievements of some of history’s most successful individuals, including Andrew Carnegie, Thomas Edison, and Henry Ford. Through these captivating stories, Hill identifies common traits and strategies that contributed to their success.

“Whatever the mind can conceive and believe, it can achieve.”

This encapsulates the core philosophy of the book and highlights the power of visualization, belief, and taking persistent action towards one’s goals.

What will I learn from this book?

- The Power of the Mind

- The Importance of Defining Your Purpose

- Persistence as a Success Trait

- The Law of Attraction and the Subconscious Mind

- Taking Action and Initiative

- Building Strong Relationships

It is noteworthy that Hill spent a significant portion of his life—approximately 20 years—researching and compiling the principles and insights presented in the book. Readers can approach “Think and Grow Rich” with confidence, knowing that Hill’s comprehensive research and dedication have laid the groundwork for a transformative reading experience.

Click here to buy:

3. The Total Money Makeover

“The Total Money Makeover” by Dave Ramsey is an excellent addition to our collection of the best finance books. This practical guide offers a step-by-step plan for individuals looking to take control of their finances, eliminate debt, and build a solid foundation for long-term wealth.

Ramsey provides clear instructions and practical advice that anyone can follow, regardless of their financial background or income level. The book emphasizes the importance of budgeting, living within your means, and adopting a cash-based system to gain control over your money.

“If you will live like no one else, later you can live like no one else.”

This quote serves as a reminder that financial discipline and wise choices in the present can lead to a life of abundance and financial security in the future.

What will I learn from this book?

- Creating a Solid Financial Foundation

- Eliminating Debt and Building Wealth

- Building an Emergency Fund

- Investing for the Future

- The Power of Intentional Spending

- Cultivating Generous Giving

By following the principles outlined in “The Total Money Makeover,” readers can regain control over their financial lives, eliminate debt, and establish a solid financial foundation. Ramsey’s no-nonsense approach, practical advice, and motivational tone make this book an invaluable resource for individuals seeking to transform their financial situation and achieve long-term financial success.

Click here to buy:

4. The Intelligent Investor

“The Intelligent Investor” by Benjamin Graham is an indispensable addition to our collection of the best finance books. Widely regarded as a classic in the field of investing, this book offers timeless wisdom and principles for approaching the stock market with intelligence and discipline.

One of the greatest strengths of “The Intelligent Investor” is Graham’s emphasis on the concept of value investing. He introduces readers to the idea of analyzing stocks based on their intrinsic value rather than short-term market fluctuations. The book teaches readers how to identify undervalued stocks and make informed investment decisions with a focus on long-term value creation.

A standout feature of the book is Graham’s thorough explanation of various investment strategies, including defensive investing and the concept of margin of safety. He provides practical advice on constructing a well-diversified portfolio, managing risk, and avoiding common pitfalls in the market. Graham’s insights encourage readers to adopt a patient, disciplined, and rational approach to investing.

“The stock market is filled with individuals who know the price of everything, but the value of nothing.”

This quote highlights Graham’s emphasis on distinguishing between the short-term fluctuations of stock prices and the underlying value of a company. It serves as a reminder to focus on fundamental analysis and make investment decisions based on sound valuation principles.

What will I learn from this book?

- The Concept of Value Investing

- Analyzing Stocks

- Constructing a Diversified Portfolio

- Managing Risk

- Margin of Safety

- Investor Psychology

In summary, “The Intelligent Investor” provides a comprehensive understanding of value investing, fundamental analysis, risk management, and investor psychology. By following the principles outlined in the book, readers can develop a prudent and disciplined approach to investing that increases their chances of long-term financial success.

Click here to buy:

5. The Psychology of Money

“The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness” by Morgan Housel is an exceptional choice for our compilation of the best finance books. This thought-provoking book explores the psychological aspects of money management, offering valuable insights into our relationship with wealth, happiness, and decision-making.

One of the standout qualities of “The Psychology of Money” is its focus on the human side of finance. Housel delves into the behavioral biases, emotions, and irrational tendencies that influence our financial decisions. By understanding these psychological aspects, readers can gain a deeper awareness of their own financial behaviors and make more informed choices.

“The highest form of wealth is the ability to wake up every morning and say, ‘I can do whatever I want today.'”

This quote emphasizes the freedom and flexibility that financial security can provide, granting individuals the ability to make choices aligned with their passions, values, and personal fulfillment.

What will I learn from this book?

- Understanding the Behavioral Aspects of Finance

- The Role of Luck in Financial Success

- Balancing Financial Goals and Personal Well-being

- Long-term Thinking and Patience

- Cultivating a Healthy Relationship with Money

- Avoiding Common Behavioral Biases

In summary, “The Psychology of Money” offers valuable insights into the behavioral and psychological aspects of finance. By exploring these points, readers can gain a deeper understanding of their own financial behaviors, make wiser financial decisions, and cultivate a healthier and more fulfilling relationship with money.

Click here to buy:

6. The Richest Man in Babylon

“The Richest Man in Babylon” by George S. Clason is a timeless classic that imparts valuable financial wisdom through captivating parables set in ancient Babylon. This book is a must-read for anyone seeking practical guidance on wealth accumulation, financial management, and personal success.

A standout feature of the book is its focus on timeless principles that transcend time and remain applicable in today’s financial landscape. Clason emphasizes the importance of saving, investing wisely, and living within one’s means. These principles, conveyed through vivid stories, provide a solid foundation for financial success.

“A part of all you earn is yours to keep.”

This simple yet profound statement encapsulates the core principle of saving and emphasizes the importance of setting aside a portion of your income for future wealth-building endeavors. It serves as a reminder to prioritize saving and wealth accumulation as a fundamental aspect of financial well-being.

What will I learn from this book?

- Living Within Your Means

- Investing Wisely

- The Power of Compound Interest

- Seeking Financial Education

- Overcoming Financial Challenges

- Building Wealth Through Timeless Principles

Additionally, the book delves into the importance of financial education and seeking advice from experts. It stresses the value of learning about money management, seeking out mentors, and making informed financial decisions. This emphasis on education empowers readers to take control of their financial destiny and make sound choices.

Click here to buy:

7. Get Good with Money: Ten Simple Steps to Becoming Financially Whole

“Get Good with Money: Ten Simple Steps to Becoming Financially Whole” by Tiffany Aliche is an excellent recommendation for our compilation of the best finance books. Aliche provides ten straightforward steps that cover various aspects of personal finance, including budgeting, debt management, saving, investing, and building wealth. Each step is accompanied by practical tips, real-life examples, and exercises to help readers implement the advice in their own lives.

“You can live a rich life without a lot of money.”

This quote underscores the overarching message of “Get Good with Money,” which emphasizes that true wealth goes beyond monetary abundance. Aliche encourages readers to align their financial choices with their values, prioritize what truly matters, and find fulfillment and contentment in their financial journey.

What will I learn from this book?

- Budgeting and Money Management

- Debt Management

- Building an Emergency Fund

- Saving and Investing

- Overcoming Financial Fears and Mindset Blocks

- Building Generational Wealth

In summary, “Get Good with Money” provides a comprehensive guide to achieving financial wholeness. By following these ten key points, readers can develop effective money management skills, tackle debt, save and invest wisely, improve their credit, plan for retirement, and cultivate a healthy money mindset. This book serves as a roadmap to financial stability, empowerment, and the ability to live a fulfilling and purposeful life.

Click here to buy:

8. Investing QuickStart Guide: The Simplified Beginner’s Guide to Successfully Navigating the Stock Market, Growing Your Wealth & Creating a Secure Financial Future

“Investing QuickStart Guide” by Ted D. Snow is an excellent addition to our collection of the best finance books. This comprehensive guide offers a beginner-friendly introduction to investing, covering essential concepts and strategies to help readers start their investment journey with confidence.

One of the greatest strengths of “Investing QuickStart Guide” is its accessible and easy-to-understand approach. Ted D. Snow breaks down complex investment concepts into simple terms, making the book suitable for readers who are new to investing or seeking a refresher. The clear explanations and practical examples make it a valuable resource for those looking to build a strong foundation in investing.

“Investing is a lifelong learning journey. The more you learn, the better equipped you are to make informed investment decisions.”

This quote emphasizes the importance of continuous learning in the realm of investing. It encourages readers to approach investing as a journey of ongoing education and highlights the value of staying informed and adapting to changing market conditions.

What will I learn from this book?

- Understanding Investment Basics

- Assessing Risk Tolerance

- Building a Diversified Portfolio

- Evaluating Investment Options

- Investment Strategies

- Understanding Market Trends

As we continue our exploration of the best finance books, “Investing QuickStart Guide” stands out as a beginner-friendly resource that equips readers with essential knowledge and strategies for successful investing. Snow’s straightforward explanations, comprehensive coverage, and emphasis on personalized planning make this book a valuable tool for anyone looking to navigate the world of investing with confidence and clarity.

Click here to buy:

9. I Will Teach You to Be Rich: No Guilt. No Excuses.

“I Will Teach You to Be Rich: No Guilt. No Excuses.” by Ramit Sethi is an excellent addition to our collection of the best finance books. This practical and engaging guide offers a refreshing approach to personal finance, focusing on automating financial systems and making smart financial decisions without guilt or excuses.

One of the greatest strengths of “I Will Teach You to Be Rich” is Ramit Sethi’s no-nonsense and relatable writing style. He breaks down complex financial concepts into simple, actionable steps that readers can implement immediately. The book’s conversational tone makes it accessible and engaging, even for those who may find finance intimidating.

A notable aspect of the book is its emphasis on creating systems and automation to manage personal finances efficiently. Sethi provides practical advice on setting up automatic savings, investment contributions, and bill payments, making it easier to stay on track and achieve financial goals without constant effort or stress.

“When it comes to money, you’re already rich. You have time. You have youth. And you have a brain.”

This quote highlights the book’s empowering message that anyone can achieve financial success by leveraging their existing resources, such as time, knowledge, and the ability to make informed decisions.

What will I learn from this book?

- Automating Finances

- Setting Financial Goals

- Optimizing Credit Cards and Bank Accounts

- Investing Basics

- Negotiating and Earning More

- Maximizing Retirement Contributions

As we continue our exploration of the best finance books, “I Will Teach You to Be Rich” stands out as a refreshing and practical guide to personal finance. Sethi’s straightforward advice, emphasis on automation, and focus on conscious spending make this book an invaluable resource for individuals seeking to take control of their finances, achieve financial freedom, and live a rich life on their own terms.

Click here to buy:

10. The Millionaire Next Door: The Surprising Secrets of America’s Rich

“The Millionaire Next Door: The Surprising Secrets of America’s Rich” by Thomas J. Stanley and William D. Danko is a captivating book that challenges common perceptions about wealth and reveals the habits and characteristics of everyday millionaires. This eye-opening exploration of the true nature of wealth offers valuable insights and practical lessons for readers seeking financial success.

One of the greatest strengths of “The Millionaire Next Door” is its in-depth analysis of the habits and behaviors of self-made millionaires. Stanley and Danko conducted extensive research to uncover the common traits and practices of individuals who have accumulated significant wealth, dispelling the notion that wealth is exclusive to celebrities or high-income earners.

“Income is what you bring home; wealth is what you save and invest.”

This quote encapsulates the book’s central theme of distinguishing between high income and actual wealth. It highlights the significance of saving and investing as key components of building true financial wealth.

What will I learn from this book?

- The True Nature of Wealth

- Building Wealth through Saving and Investing

- The Role of Entrepreneurship

- The Influence of Education and Continuous Learning

- The Impact of Social Influences on Wealth

- The Significance of Long-Term Financial Planning

In summary, “The Millionaire Next Door” offers valuable insights into the habits and characteristics of self-made millionaires. You will gain a deeper understanding of wealth-building habits, including frugality, saving and investing, entrepreneurship, continuous learning, and long-term financial planning. This book serves as a guide for anyone seeking to achieve financial prosperity and build lasting wealth.

Click here to buy:

The realm of personal finance is vast and complex, but these personal finance books serve as invaluable guides, equipping readers with the knowledge and tools to navigate the financial landscape with confidence.

From budgeting and saving to investing and wealth management, personal finance books cover a wide range of topics that are essential for achieving financial stability and success. They provide insights into strategies for debt management, retirement planning, tax optimization, and building generational wealth. Whether you’re a beginner looking to establish a strong financial foundation or a seasoned investor seeking advanced insights, there is personal finance books tailored to your needs.

It’s important to recognize that personal finance books are just the starting point. The true power lies in taking action and implementing the knowledge gained. Applying the lessons from these books to real-life situations is what ultimately transforms financial literacy into financial success. It requires discipline, perseverance, and a willingness to adapt to changing circumstances.

While personal finance books offer valuable insights, it’s crucial to approach them with a critical mindset and consider multiple perspectives. The financial landscape is ever-evolving, and what may have worked in the past might not be applicable in the present. Continual learning, staying informed about current trends, and seeking professional advice when needed are key components of a successful financial journey.

Personal finance books have the power to transform our relationship with money and pave the way for financial freedom. They educate, inspire, and empower individuals to take charge of their financial future. By arming ourselves with knowledge, implementing sound financial principles, and seeking ongoing education, we can navigate the complexities of personal finance with confidence and work towards achieving our long-term financial goals. So, let these personal finance books be your trusted companions on the path to financial prosperity, but remember that the true measure of success lies in the actions you take to shape your financial destiny.

Read more about Self-Improvement Books and Autobiography Books!